Innovation Roadmap

From discovery and development to adoption and spread.

Our guide to the innovation roadmap

For a new or innovative diagnostic test, treatment or technology to move from the bench to the bedside, it must go through a variety of activities before it can be used to improve patient experiences and outcomes. We call this the innovation roadmap.

This tool acts as our explainer of the roadmap. Here, we outline the general process that occurs when a diagnostic test, treatment, or technology is developed and then delivered into the health system. This process is complex, often not sequential and varies for different types of innovation, but a general pattern can be described. We highlight some of the barriers slowing down the translation of groundbreaking innovations into cancer care and note some of our recommendations to help solve these, helping us live, longer better lives.

At Cancer Research UK, we have invested £4bn into cancer research over the past decade and we hold expertise across the entire roadmap. From funding groundbreaking discovery research to helping develop cutting-edge spin-outs with our commercial wing, Cancer Research Horizons, to engaging with health system and civil service stakeholders to advance patient access to high quality, evidenced innovations.

We want government, universities, and health systems to support the translation of research and the timely adoption of proven innovations so that everyone across the UK affected by or at risk of cancer has access to life-changing interventions and to make the UK more attractive to the globally competitive life sciences industry. More of our recommendations on this can be found in our programme for government, Longer, better lives (2023), and in our translation and innovation policy work.

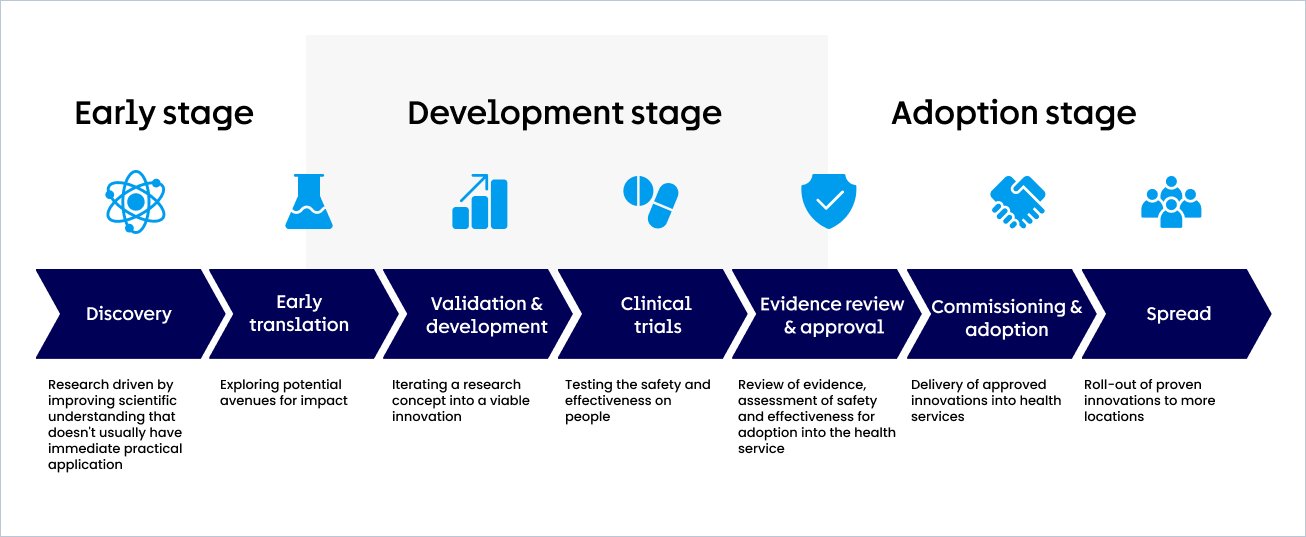

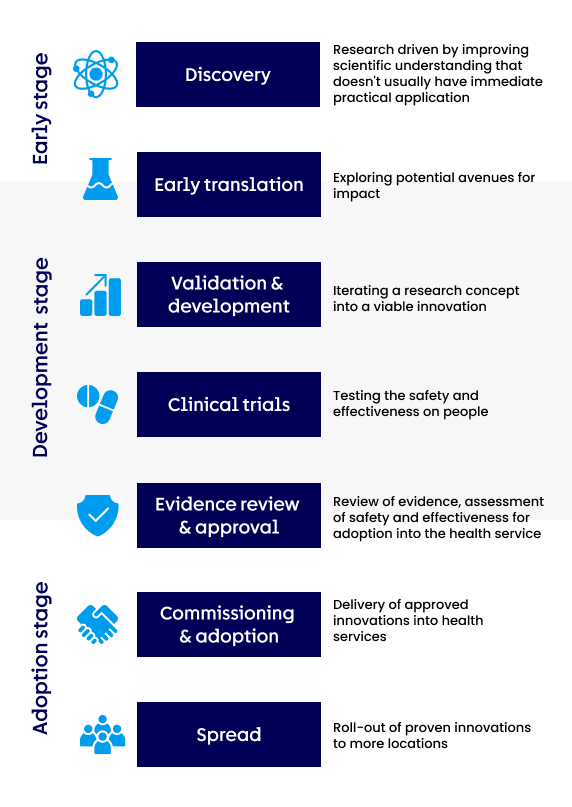

The seven activities of the roadmap

The innovation roadmap is not always sequential and varies for different types of innovation. However, we can simplify it into seven distinct activities:

Looking at the roadmap through a case study: Zynlonta

Zynlonta produced by ADC Therapeutics is an exciting new drug that Cancer Research Horizons has helped develop. Follow its journey from bench to bedside through the roadmap.

Discovery

Research driven by improving scientific understanding that doesn't usually have immediate practical application

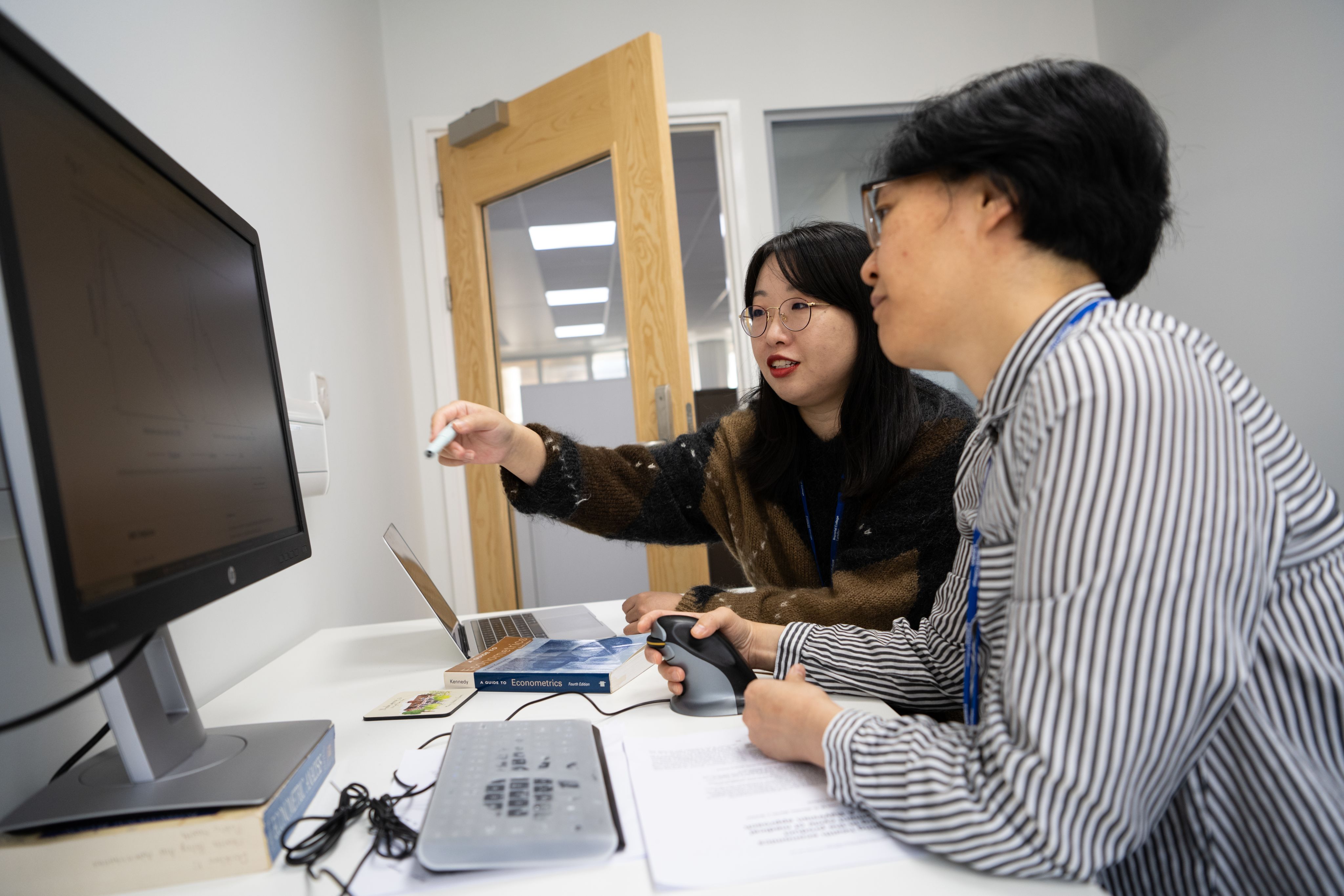

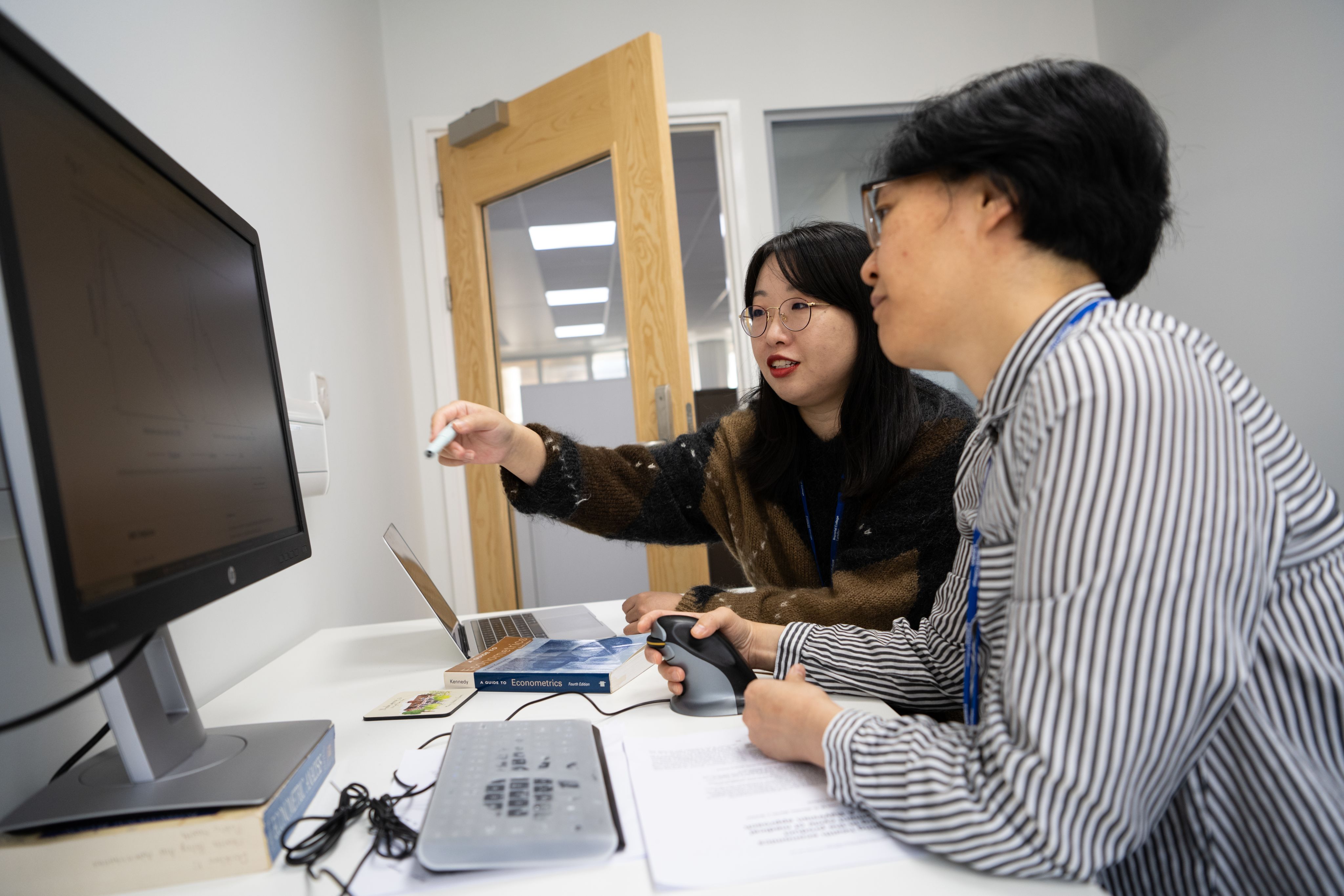

Discovery science is the basis of innovation

Discovery research explores ideas that build our understanding of health and disease. Explored either theoretically or more commonly through experimentation, understanding from these ideas can uncover new opportunities to alter the status-quo of healthcare. For example, researchers investigate how cancer develops, why the immune system fails to recognise tumours, and how cancers in the body change to become resistant to treatment. This can also include many different methodological approaches and sciences.

The UK is a world leader in many aspects of discovery research, with our academic institutions and institutes producing 11.5% of global medical science citations.

Cancer Research UK has four institutes: Scotland, Cambridge, Manchester, and the Francis Crick. These bring scientists together to tackle the fundamentals of cancer. We also provide grant funding across the country and internationally for the most exciting cancer research.

Looking at the roadmap through a case study: Zynlonta

At Portsmouth in the early 1990s Biologist John Hartley was investigating exactly how various DNA-targeting chemotherapy agents functioned. Meanwhile medicinal chemist David Thurston was at the University of Portsmouth experimenting with chemicals called PBDs that bind to DNA and could potentially bind to cancerous cells. Both were funded by Cancer Research UK. Their research didn’t aim for immediate application but was driven by a need for more effective treatments for people with relapsed or hard-to-treat cancers. Realising that their work could come together they began working as a team.

What are some of the discovery challenges?

- A lot of discovery research happens in universities, but many are facing severe financial difficulties. For the best cancer research to occur in the UK, universities must be financially secure.

- Nearly two-thirds (62%) of the publicly-funded cancer research in the UK comes from the charity sector, whereas around 38% comes from the government. Charities are sensitive to changes in the external environment, such as during COVID-19 when the sector saw a large drop in income.

- High visa costs can make it hard for the UK to attract the best international scientists.

- Despite the UK’s significant health data assets produced in clinical settings, some of this data remains difficult to access by discovery teams.

Some of our recommendations

- The UK Government should work with industry, research funders and research charities to set out a plan to create a more resilient funding environment for cancer research.

- The UK Government should make immigration costs internationally competitive for researchers.

- The UK Government should deliver and sustainably fund the announced Health Data Research Service.

You may be interested in:

Cancer News: The UK immigration system is holding us back in the fight to beat cancer

Cancer News: How Secure Data Environments can help drive advances in health data research

Cancer News: Why investing in cancer research is good for the economy

Early translation

Exploring potential avenues for impact

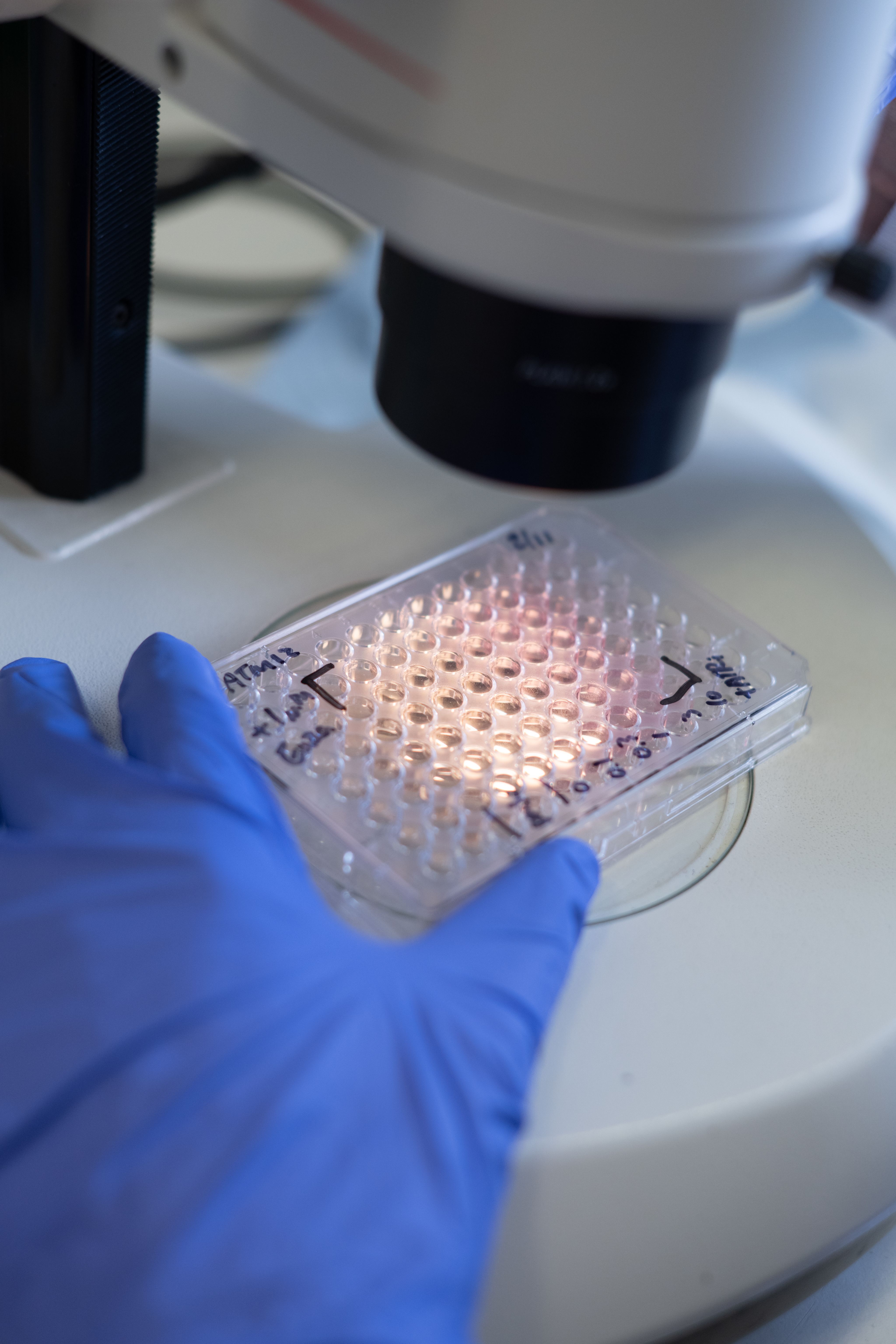

Transforming discoveries to directly aid people

The lines between discovery and translational research are blurred, but the basis of translation relies on understanding the potential of turning discoveries into useable tools and technologies.

When a promising discovery is made at the discovery stage it can be further explored to assess its potential for real-world use.

The main avenues for translational research are spin-out creation and licensing

Academics with a novel discovery that has been sufficiently developed may begin the process to spin-out a company, seeking investment, finding lab space, and hiring scientists and other staff to build up a company that can further develop the potential asset. Depending on the discovery or innovation, a researcher may instead wish to license their discovery to a larger firm, which can then develop it further, or work with a larger company and co-develop it.

Tech Transfer Offices (TTOs) in the academic’s university are often integral and can help bridge the gap between academic research and commercialisation. They give advice, help manage the creation of intellectual property (IP)/patents, and support industry interaction. Academics funded by Cancer Research UK have access to Cancer Research Horizons which can also support with these activities.

Securing investment

Securing capital is critical here and this may come from public research funders, industry or charitable research and development (R&D) funders, such as Cancer Research UK via Cancer Research Horizons, or angel investors. Public funders are likely to fund academic validation and development whilst angel investors will invest in commercial development. The capital required can be substantial. Accelerators that support early-stage companies with investment as well as mentorship can also be useful here.

For some technologies, spin-outs are critical for delivering impact. For others, licensing can be the most viable route, enabling innovations to progress along the roadmap. In the 2023-24 financial year Cancer Research UK, via our innovation engine Cancer Research Horizons, created 6 new start-ups and engaged in 106 commercial licensing deals. It’s important that there is sufficient government support and attention to facilitate both spin-out creation and licencing. It is also worth noting that industry will develop technologies and innovations based on discovery science that has been published and not protected by IP or where IP has run out.

Demonstrating potential

As well as exploring avenues for real-world impact, a lot of time and effort often goes into performing experiments at this stage. These experiments look to demonstrate the innovation’s potential. The early evidence from these experiments is essential for securing investment. The focus on determining whether a discovery has clinical application distinguishes this activity from discovery research.

Further research may involve studying current patient data and market analysis. If potential for impact is found, then securing the IP rights can be a key step - ensuring that the innovation can be commercialised.

Looking at the roadmap through a case study: Zynlonta

Cancer Research UK sought to test some of the most promising PBD work, which included Thurston and Hartley’s. Their results led to Cancer Research UK’s commercial partnership wing getting in contact to say that they thought this was a promising target for a spin-out company.

As a result Spirogen, a London-based spin-out with funding from Cancer Research Horizons and other shareholders, was formed. This would centre on the fact that PBDs could exploit the way that rapidly dividing cells are sensitive to disrupting DNA, and that no drug has been created with them yet.

What are some of the early translation challenges?

- Despite the need for cash and recent improvements there is lack of funding dedicated to early translational research. This is often called the valley of death, the gap between having an invention and it being developed enough for others to be able to invest.

- There are conflicting drivers for translation and academia. Academic researchers are often assessed on their ability to publish, while translational work does not always lead to publications in high impact journals.

- Where funding does exist, it is often concentrated in South East England and London. The UK Government’s spin-out review from November 2023 found that spin-outs in the Southeast, London and East of England made up 74.5% of all investment into spin-outs in the 2021/22 financial year. This means that there could be untapped potential across the UK.

- Supporting entrepreneurship is also very important at this stage. There are examples of programmes and training but, despite some improvements, there should be more incentives for researchers to try and commercialise their work.

Some of our recommendations

- The UK Government should work with research councils and universities to better incentivise translational research as well as entrepreneurship, such as when researchers are assessed in job promotion criteria and grant applications.

- The government should follow through with the recommendations made within the 2023 Independent Spin-out review.

You may be interested in:

Cancer Research Horizons: Our translational science

Cancer Research Horizons: The UK spinout review: moving beyond equity

Validation & development

Iterating a research concept into a viable innovation

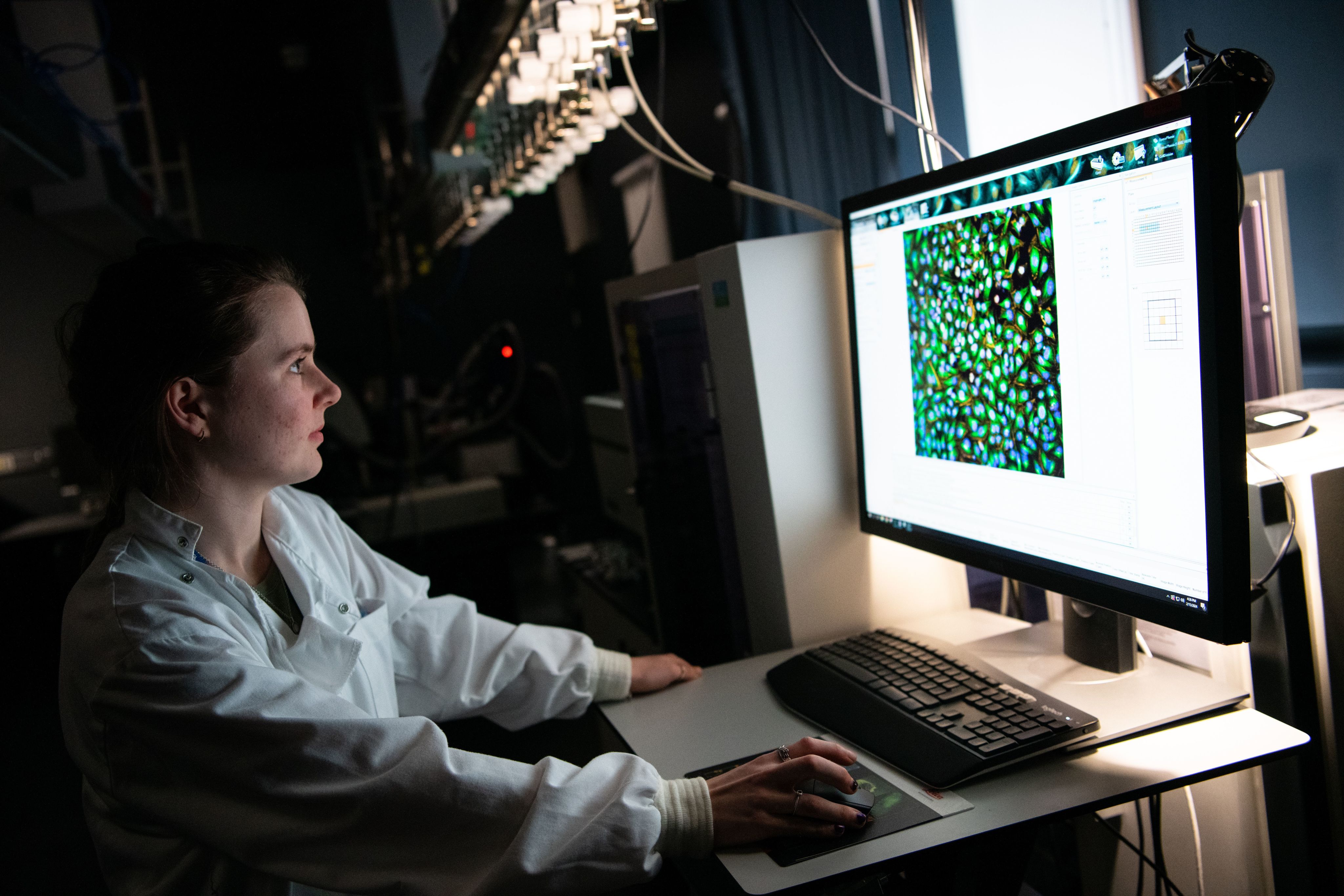

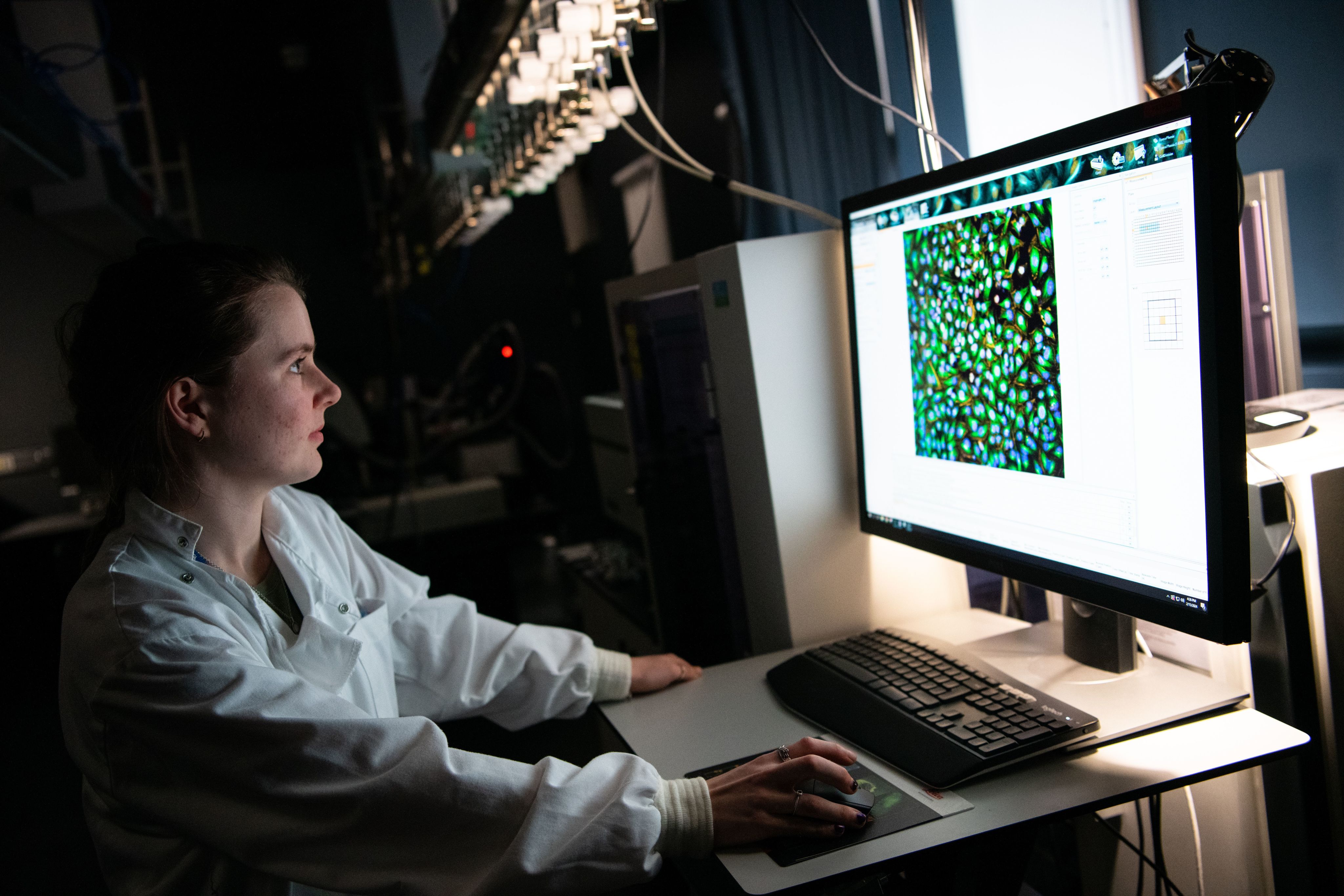

A viable innovation begins to be formed

Refining and developing the innovation. This often happens in parallel with early translation, where different routes to impact are explored. Here, research is continually and iteratively scaled up and validated, and we will see further rounds of funding. This process will begin with a minimum viable innovation and through this stage of testing cycles will end with a finished innovation that is ready for market (if successful at clinical trials and if relevant for the type of asset).

Before a medicine reaches clinical trials, it must undergo pre-clinical testing to de-risk the move to human studies. This involves intense pre-clinical checks, often including studies on human tissues and may involve studies in model systems. In some cases, animal research is a prerequisite for subsequent clinical studies. The innovator must apply to begin clinical trials through their national regulatory agency. In the UK, this is the Medicines and Healthcare products Regulatory Agency (MHRA). Within Europe, it’s the European Medicines Agency.

For most medical devices and In Vitro Diagnostics (IVDs) the innovation will need to undergo conformity assessments and adhere to the relevant regulations to gain the UK Conformity Assessed (UKCA) marking, which is needed to be able to sell within the UK.

Although a significant amount of industry-led development often occurs before clinical trials, depending on the innovation, some innovative scale-up can be done at-risk in parallel with clinical trials to lead to efficient innovation release upon approval.

Looking at the roadmap through a case study: Zynlonta

By the mid 2000s Cancer Research Horizons and Spirogen began the first preclinical and early clinical testing. But issues with toxicity where the chemicals would impact too many other non-cancerous cells thwarted development.

Working with US Biotech Seattle Genetics, Genentech and AstraZeneca – the firm developed further iterations, improving the toxicity issues by combining with antibodies to create ADCs – a new type of chemical that target just the cancer cells.

Whilst doing this the team realised there was a potential spin-out of the spin-out and in 2012 created ADC Therapeutics, to create the ADC’s themselves. Zynlonta was one of these.

What are some of the validation & development challenges?

- After the initial set-up there can be difficulties in maintaining or growing funding. This is especially true for commercially non-viable innovations, such as for rare cancer treatments or treatments for children and young people’s cancers, where innovations often get stalled. Cancer Research UK with LifeArc are seeking to address this market failure with C-further - a Children’s Cancer Therapeutics Consortium – with an initial investment of £28m.

- It can often be difficult to understand what key experiments are needed to move a project forward to make it more commercially viable. The types of experiments needed differ depending on the type of innovation, making for a confusing landscape even if an inventor has experience from a previous innovation.

Some of our recommendations

- The Department for Science, Innovation and Technology (DSIT) should work with the Treasury and the Department for Business and Trade to enhance and expand government-backed schemes that encourage investment from larger investment funds into the early stages of translation to support UK-based life sciences companies. This should include, but not limited to, collaborating with the pension industry to re-allocate pension funds.

You may be interested in:

Clinical trials

Testing the safety and effectiveness on people

When an asset is tested on people

Clinical trials are research studies that test innovations on people. They are used to tell us about the innovation’s efficacy and safety for use.

Currently, patients access most trials through their clinician. Clinicians identify eligible patients, discuss potential participation, and facilitate enrolment. This often relies on the clinician's knowledge of ongoing studies, clinical trial registries, and professional networks to match patients with suitable trials. Alternatively, data-driven recruitment allows researchers to identify potential participants from a database, but this is the exception rather than the norm.

This step may differ for some types of health tech innovations if it is not necessary to test effectiveness or safety in the same clinical trial phases.

Different innovations will go through different phases of clinical trials, but the standard process for medicines are as follows:

- Stage 0 (Small: 10-20 people): Testing a low dosage of treatment to check for safety.

- Stage I (Small: 20-50 people): Finding the best dose of treatment, what the potential side effects are and about any off-target effects.

- Stage II (Medium: 50-100+ people): Confirming the best dose of treatment, exploring a wider-array of side effects and exploring treatment efficacy.

- Stage III (Large: 100-1000+ people): Comparing the new treatment to the standard treatment or to a dummy drug.

As well as being supported by industry, trials are supported by public and charity funders, healthcare systems and public healthcare bodies. Support includes funding, management, regulation or guidance. Clinical trials must be attributed to a ‘sponsor’, who is responsible for the running and reporting of the trial. Sponsors can be commercial (e.g. a pharmaceutical company) or non-commercial such as the health service, universities or charities. The National Institute for Health and Care Research is the key UK public funder, with charities also playing a vital role. For example, Cancer Research UK supports key trial infrastructure across the UK via our network of Clinical Trial Units and Experimental Cancer Medicines Centres.

Looking at the roadmap through a case study: Zynlonta

After scoping out a clinical trial plan, the first dose of Zynlonta was administered to a patient in March 2016. In 2020, results of the 145-person Phase 2 trial showed that 48% of patients responded to Zynlonta, with 24% entering complete remission.

It was thanks to these impressive results that Zynlonta was put forward for the approvals stage.

What are some of the clinical trials challenges?

- The UK’s clinical trial set-up performance has been a concern for the last few years. Whilst there has been some progress, there needs to be more efforts to approve trials quickly and ensure other bottlenecks are resolved.

- It can be difficult for innovations deemed commercially non-viable to undergo clinical trials due to a lack of funding or resource. For these trials charitable investment becomes key for development.

- Although progress is happening, data driven recruitment into trials – where researchers can search for eligible patients - is still not widespread.

- It can be difficult to fund late-stage clinical trials, especially where long-term data is required, such as mortality endpoints.

- There are often difficulties with ad hoc patient recruitment. There are difficulties when clinicians have little time to engage in clinical research. This is due to a lack of workforce and resource for carrying out clinical trials within UK health systems.

- There are often issues with the diversity of patients that sign up to clinical trials. This can sometimes mean that the data generated is not representative of the general public.

Some of our recommendations

- Support senior health system leaders across the UK to monitor and evaluate research engagement and impact at Trust/ Health Board, regional, and national levels. Research should be embedded in the NHS Mandate.

- Enable more clinical time to be dedicated to research, including in professions currently under-represented in research (for example nurses and Allied Health Professionals).

- UK health systems should develop a faster and less bureaucratic process for non-commercial trials, including mandating a single negotiation and sign-off process for costing and contracting trials within the NHS.

You may be interested in:

Cancer News: Why the next government needs to support clinical research – for our health and the NHS

DETERMINE: The first UK national precision medicine trial in rare cancers

Cancer News: Oesophageal cancer screening trial begins testing the capsule sponge

Evidence review & approval

Review of clinical evidence, assessment of safety and effectiveness for adoption into the health service

At this stage of the roadmap, the activities involved in approval and adoption of an innovation into the health system vary depending on the type of innovation you’re looking at. This path is clearest for medicines, but less clear for non-medicinal products and technologies.

Evidence review and market authorisation

For an innovation to be licenced for sale and adopted into health services in the UK, the evidence supporting its use needs to be reviewed and appraised.

For regulatory approval, innovators must present the clinical evidence for their innovation to the Medicines and Healthcare products Regulatory Agency (MHRA), regulator of all medicines and medical devices in the UK. MHRA assesses the evidence for safety, quality and efficacy and the evidence required will differ depending on the innovation. If MHRA grants ‘market authorisation’ for an innovation, it is approved, or ‘licensed’, for sale on the UK market.

Assessment of clinical effectiveness and cost

Depending on the innovation, it may need to undergo a formal approval process, known as a Health Technology Assessment (HTA), and a business case to convince commissioners of the innovation’s value.

There are different HTA bodies across the UK. The National Institute for Health and Care Excellence (NICE) covers England and Northern Ireland, with the Department of Health in Northern Ireland deciding whether to adopt NICE recommendations. NICE reviews the evidence for an innovation, assesses it’s clinical and cost effectiveness and makes recommendations about using it in health and social care settings. The pathway is similar in Scotland and Wales, with equivalent organisations including Health Technology Wales, Scottish Medicines Consortium (SMC) and Scottish Health Technology Group.

All new medicinal products must be submitted for HTA approval and if approved, there is a statutory requirement for the NHS in England, Scotland and Wales to commission the medicine for patient use within 3 months. In Northern Ireland, once the Department of Health has reviewed a recommendation from NICE for applicability within the Northern Ireland context and published an endorsement, Health and Social Care Trusts must have plans in place to adopt the new product within 3 months.

For different types of innovation there are different pathways to approval within MHRA and the HTA bodies – for example, a medicine is required to follow a different route to approval than a digital innovation. For some innovations, the choice of pathway could expedite a positive decision or influence funding sources. These include the Innovative Licensing and Access Pathway (ILAP), the Innovation Devices Access Pathway (IDAP), Early Access to Medicines Scheme (EAMS) and NICE’s Early Value Assessment (EVA) for technologies.

For all innovators, having clarity and certainty in the route to adoption for their innovation is essential. Without this, they may be less likely to develop or seek market approval for their innovation in the UK.

Looking at the roadmap through a case study: Zynlonta

Zynlonta was recently approved by NICE for use in the NHS, with guidance published in January 2024. Similarly, the SMC approved and published guidance for its use in Scotland in January 2024.

What are some of the evidence review & approval challenges?

At times in recent years, MHRA have struggled to meet the 30-day approval target. Progress has been made to address these delays and backlogs, but sustained funding is needed to protect the organisation’s long-term capacity.

Like MHRA, HTA bodies’ capacity is stretched, meaning that turnaround times for applications can be slow and alignment is needed between HTA bodies to streamline evidence requirements.

For all innovations, including medicines, detail about who is eligible and the evidence required to partake in the different approval routes and schemes available is not always clear to innovators.

For non-medicine products, like medical and digital technologies, the pathways from approval to adoption are at best unclear or inconsistent, and at worst non-existent. There are multiple complications here:

- Submission for NICE approval is not a compulsory process for medical technologies. Steps to approval for non-medicine products are ambiguous, guidelines are evolving, and evidence thresholds are blurry for those who do submit. This means innovators are often unclear on the most effective route to get their innovation adopted.

- For innovations that do get HTA approval there is no guarantee that they will be commissioned within the health system in the same way medicines are. This can deter innovators from seeking HTA approvals if there is uncertainty that the cost and effort of applying for NICE approval will be worthwhile.

- Even if an innovation is proven to be safe, cost-effective and delivering benefits to patients or clinical staff, the next steps post-approval are unclear and uncertain.

Some of our recommendations

- The Department of Health and Social Care (DHSC) and devolved equivalents must provide MHRA with adequate and sustained funding to ensure capacity can keep pace with demand and safeguard against staff and skills shortages. This should include working with the Office for Life Sciences (OLS) and the Department for Science, Innovation and Technology (DSIT) to work to map and signal emerging cancer innovations to areas of clinical unmet need.

- DHSC, MHRA, NICE, and devolved equivalents, should clearly define routes to adoption from pre-market authorisation to commissioning for emerging innovations, including AI applications, digital technologies and diagnostic tests. This should set out accountabilities and responsibilities, evaluation criteria, evidence thresholds and cost-effectiveness requirements.

You may be interested in:

Cancer Research UK: How cancer medicines are licensed in the UK

Commissioning & adoption

Delivery of approved innovations into health services

Commissioning and purchasing

Decisions to commission innovations are made in different settings across the four UK nations. Depending on the nature and scale of the innovation, there may be national specialised commissioning required (such as through the Joint Commissioning Committee in Wales), regional commissioners/providers such as Health Boards in Wales and Scotland, or even individual providers, such as English trusts or Health and Social Care Trusts in Northern Ireland, if addressing a more local problem.

Integrated Care Boards in England, Health Boards in Wales and Scotland and Trusts in NI are required to make medicinal products with a new HTA approval available to patients within 3 months. There is no legal requirement for commissioners to make HTA approved diagnostics and medical technologies available to patients within a set time period, as the route to commissioning for these innovations isn’t clearly set out.

Adoption

To place an innovation into a particular setting, there is a process of testing, refinement and evaluation.

In England there are 15 NHS Health Innovation Networks (HINs) that bring together Integrated Care Systems (ICSs), local authorities, charities, innovators and industry to help facilitate the development, piloting, and adoption of innovations for improved patient outcomes. Similarly, there are organisations who support and facilitate the adoption of innovations in Scotland, Wales and Northern Ireland. There are three Regional Innovation Hubs in Scotland, the Life Sciences Hub and Cancer Industry Forum in Wales and the Health Innovation Research Alliance Northern Ireland. These organisations play a key role in streamlining the adoption of innovations by connecting academics and industry with government and healthcare providers to ensure new innovations best meet patient needs and by offering expertise along the roadmap.

Piloting

To build evidence for an innovation’s efficacy (compared to current practice) and to make the case for commissioning, medical devices and software are often piloted on a smaller scale, in a local setting, through one ICS or even a singular hospital. This helps refine how the innovation is utilised within a particular system context. Further, this helps identify feasibility issues and learnings from using the innovation in the system in practice.

Looking at the roadmap through a case study: Zynlonta

From January 2024, Integrated Care Boards, NHS England and local authorities had 3 months to make Zynlonta accessible to patients in England. Welsh ministers have issued directions to the NHS in Wales to follow the implementation guidance from NICE. Zynlonta is now available for prescribing on the NHS in Scotland.

What are some of the commissioning & adoption challenges?

- The overall lack of standardised routes to adoption for different types of innovations poses challenges for innovators, commissioners and budget holders across the UK. With new types of innovations emerging (e.g. AI tools), it’s increasingly difficult to know when an innovation is ready to be adopted, whether it’s cost effective and what alternative options exist. Differences in the commissioning approach can result in unwarranted variation in the uptake of innovations across the UK.

- Often the funding for pilot schemes may only be available for a limited period, restricting the ability to collect sufficient data to properly consider long-term adoption of the innovation. Similarly, it can be difficult to share data from pilots across regions or trusts, even if the same innovation is being piloted in those different locales.

Improved data-sharing across regions could help reduce duplication, share lessons learned and could aid wider adoption or spread. There are innovation networks and organisations across the UK that are seeking to smooth these hurdles and drive the adoption of innovations at a local level.

Some of our recommendations

- With direction from national level leadership, local organisations must work together to develop a coherent, shared strategy for the identification, adoption and implementation of approved cancer innovations across their geographies, using evidence obtained from research across the health service.

- National level decision makers should develop a coordinated set of metrics to monitor and evaluate health system research engagement and impact at Trust/Health Board, regional and national levels.

You may be interested in:

Cancer Research UK: How medicines become available on the NHS and HSC

Cancer Research UK: A pilot study on robotic surgery for ovarian cancer (MIRROR-RCT)

Spread

Roll-out of proven innovations to more locations

Rolling out the best

Just because an innovation has been adopted effectively in one local area, it doesn’t necessarily mean it will work to be rolled out and spread to others.

Spread is vital to the success of innovations; without it, many patients may lose out on access to new methods of cancer diagnosis and treatment. To ensure maximum utility of proven innovations in practice, NHS England has encouraged all innovations to be scalable and applicable to a variety of settings; from a small set-up within a single Integrated Care System, to multiple adoption sites across different regions, or even nationwide.

Looking at the roadmap through a case study: Zynlonta

Cancer Research UK is excited by the possibility of the spread of Zynlonta throughout the UK’s NHS. We’ve seen its success in the USA and the EU. With positive evaluation, Zynlonta should be accessible to those who need it.

What are some of the spread challenges?

- The adoption and spread of innovations in the health system is a complex, expensive and time-intensive process, even when the innovations themselves appear easy to implement.

- Funding is often identified for piloting innovations, but there is a lack of funding for the adoption and spread of innovations.

- It is not always clear to regional or local health systems which of many promising innovations available they should prioritise adopting, partly because local horizon scanning functions are either not being maximised or are limited in resource.

While a drive at the national level can be particularly impactful, spread can occur at any level. It’s important that these issues are addressed to ensure that the most impactful cancer innovations are being identified for national roll out, as well as local and regional level spread.

Some of our recommendations

- DHSC should routinely conduct targeted horizon scanning to identify the most impactful cancer interventions that should be prioritised for national roll-out. This must involve working closely with national and local delivery teams for screening and cancer care, Cancer Alliances, Health Innovation Networks, clinicians, researchers and Cancer Research UK.

- DSIT, OLS, DHSC and devolved equivalents must work with the wider innovation ecosystem to align priorities and strategies intended to support innovation in healthcare to develop a cross-department action plan that looks to accelerate the adoption of health innovation to improve cancer outcomes.

You may be interested in:

Cancer Research UK: Our policy on access to cancer treatments

Cancer News: Cancer inequalities: The problem of unwarranted variation in access to treatment

To speak to Cancer Research UK about this roadmap, get in touch here. Citations provided on request.